Unemployment Number Reality Check

We’ve seen a lot of news recently about a decreasing unemployment rate and lower unemployment filings on a monthly basis. No question that this is a good thing, but while all of these unemployment numbers are decreasing there is a major storm brewing for the United States employment picture. The first quarter of 2011 should see the fallout of seasonal temporary workers, and a recent interest in private equity, and mergers and acquisitions (M&A) should have made plans to downsize by then.

Layoffs / Downsizing

For instance Yahoo is cutting about 650 workers in November, however rumors say it could go as high as 1300 workers.

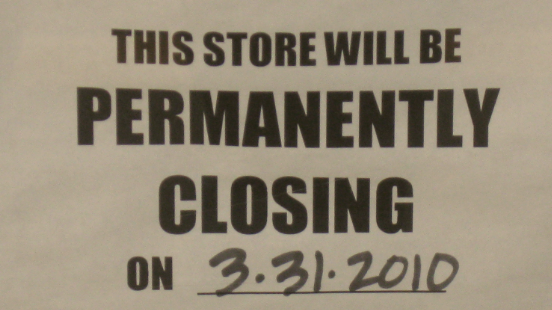

TJX Cos the owner of stores such as T.J. Maxx and AJ Wright will be closing the AJ Wright brand and eliminating 4400 jobs. 71 stores will be completely closed, and 91 will reopen under different brand names like T.J. Maxx.

Temporary Seasonal Worker numbers

There is massive amounts of temporary workers being hired for the holidays and the Christmas gift buying rush and shipments of those gifts. Here is a sample of the hiring frenzy which will result in a layoff frenzy.

14,000 Fedex temporary workers.

15,500 Amazon temporary workers.

40,000 Kohls temporary workers.

45,000 Toy R Us temporary workers.

165,500 total jobs from 5 companies above that will result in the vast majority of those jobs vanishing. Toys R Us opened many pop up stores called Toys R Us Express in old KB Toys locations for only the holidays.

The employment picture is even more dire when you look at the result of the temporary hiring that Amazon is doing. People are turning into migrant workers to get a temporary job, read about it in full at USA Today.

Kelley Services which is one of the nation’s largest outsourcing companies announced that it’s revenue was up 22% on higher temporary workers.

Private Equity Buyers Strike Again

If you think that it isn’t a big deal for private equity buyers to run around and take companies private think again. Bloomberg Businessweek recently highlighted some of the costs associated with being a publicly traded company in a piece about major corporations switching from NASDAQ and NYSE listings to Pink Sheets.

Taking a company private would result in further cost savings because it does not have nearly as much financial reporting compliance issues to worry about. Entire corporate departments are able to be eliminated by going private, not to mention any other areas that new private investors will cut thin to maximize their investments.

Recent Private Equity Purchases:

- Attachmate buys Novell for $2.2 billion, Novell will sell some patents to a Microsoft group and the deal will only cost Attachmate about $650 million after accounting for cash on hand.

- Del Monte going private for $4 billion.

- J Crew going private for $3 billion.

In closing it’s pretty obvious to the people living in the real world that good jobs, like ones that have a career path are hard to come by. For example Delta Airlines had 100,000 applications for only 1,000 flight attendant openings. The unemployed are looking for work; there just isn’t enough to go around.