New York Gig Worker Unemployment Insurance Filing help

New York State has a different process to file for Unemployment Insurance benefits if you are a gig or contract worker affected by the COVID-19 Coronavirus pandemic non-essential worker shutdowns. Below is a quick step by-step guide of what to do.

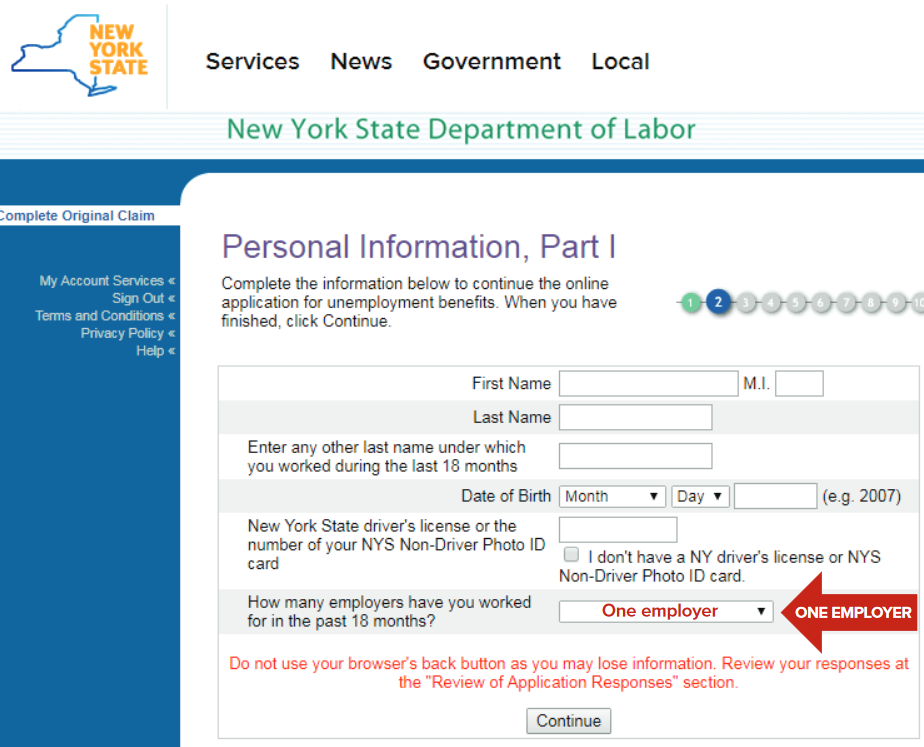

PERSONAL INFORMATION, PART I

“How many employers have you worked for in the past 18 months?”

In answering this question, count yourself as an employer if you were self-employed.

In the example below, if you had no other employment in the past 18 months, select “One employer” from the drop-down.

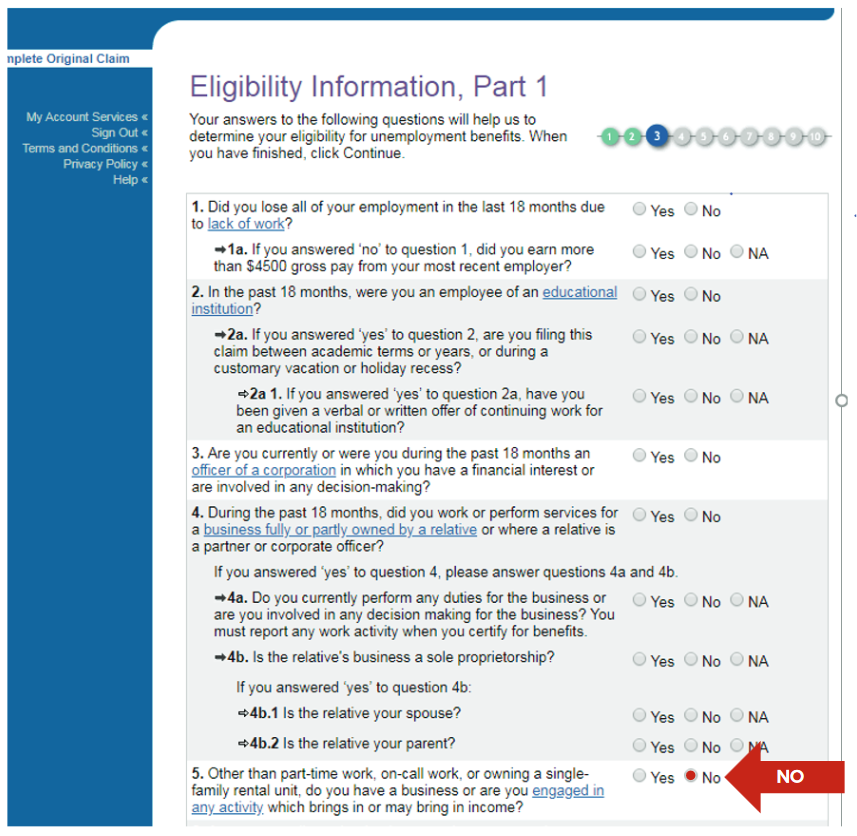

ELIGIBILITY INFORMATION, PART 1

Question #5. “Other than part-time work, on-call work, or owning a single-family rental unit, do you have a business or are you engaged in any activity which brings in or may bring in income?”

In answering this question, think of your self-employment as a “business or any activity” and identify whether you are still self-employed or if that still “brings in or may bring in income.”

In the example below, select “No” if you are no longer self-employed or if your self-employment no longer brings in income.

MOST RECENT EMPLOYER INFORMATION, PART 1

“The Federal Employer Identification Number (FEIN) is a 9-digit number which can be found on your copy of the W-2 form from the employer.”

“Federal Employer Identification (FEIN):” – Leave blank

“If you do not know the FEIN, enter your most recent employer’s New York State Employer Registration Number (ER) Number. The ER number is a 7-digit number which can be found on the IA 12.3 Record of Employment form which your employer may have provided you.”

“New York State Employer Registration Number (ER Number)” – Leave blank

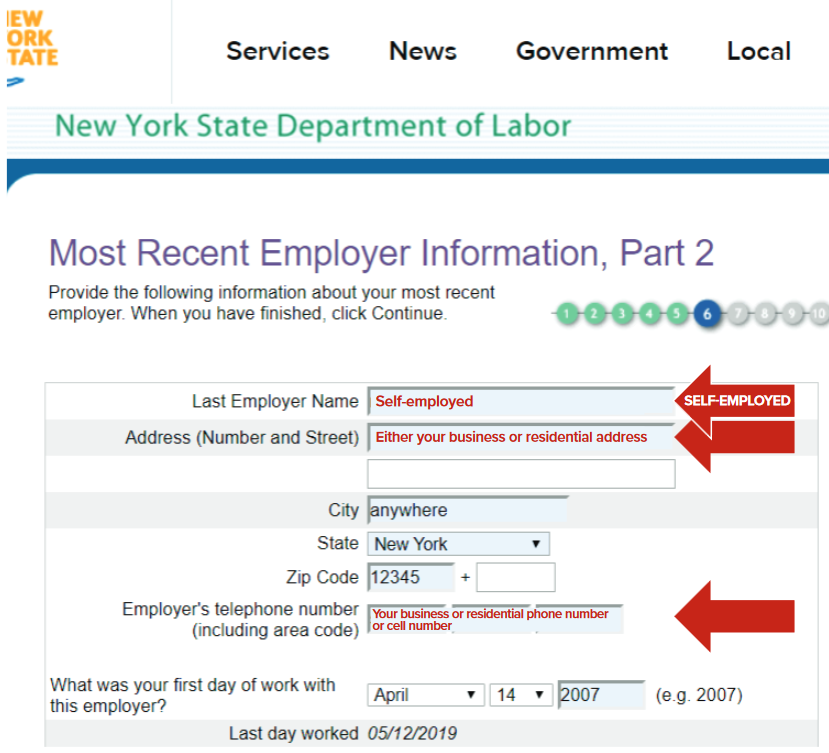

MOST RECENT EMPLOYER INFORMATION, PART 2

“Provide the following information about your most recent employer. When you have finished, click Continue.”

“Last Employer Name” Type “Self-employed”

“Address” Enter either your business or residential address

“Employer’s telephone number:” Enter either your business or residential phone number or cell number

Do you have other New York unemployment help tips for me? Yes we do here at our New York Unemployment Insurance Frequently Asked Questions page.