How to Apply for Michigan UIA Mixed Earners Unemployment Compensation (MEUC) Program

So what is Mixed Earners Unemployment Compensation (MEUC)?

MEUC provides an additional $100 per week in supplemental benefits to individuals with at least $5,000 in net income from self-employment during the most recent taxable year.

Potentially eligible claimants will receive a notice either by mail or in their Michigan Web Account Manager (MiWAM) about the availability of MEUC and how to apply.

The MEUC program was created as part of the federal Continued Assistance Act (CAA) and provides an additional $100 per week in supplemental benefits and is payable for the weeks ending January 2, 2021 through the week ending March 13, 2021.

To Be Eligible for MEUC

- You must be currently receiving unemployment benefits from a program other than Pandemic Unemployment Assistance. MEUC is not available for individuals receiving PUA.

- You must have earned at least $5,000 in net self-employment income in the most recent taxable year.

- Claimants must be receiving unemployment benefits for weeks covered by the MEUC program, which are January 2, 2021 through March 13, 2021. Must be eligible to receive at least one dollar of our underlying benefit amount for the week claimed to receive the full $100 MEUC payment.

- Must apply online for the MEUC program and submit proof of self-employment income.

Proof of Self-Employment Income Requirement

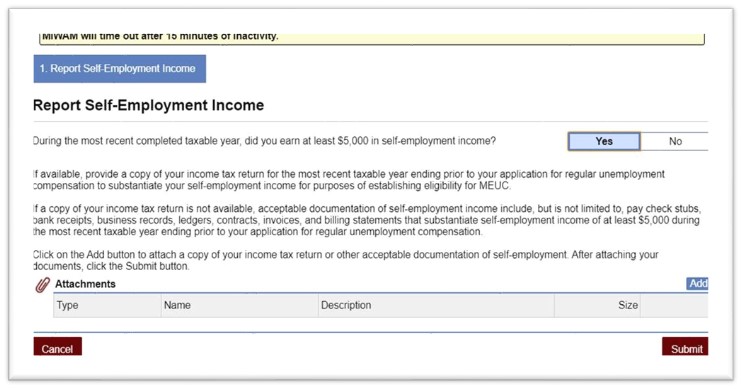

“Self-employment income” means the net earnings from self-employment obtained during a taxable year. If your unemployment claim was filed in 2020, you must provide self-employment income documentation from your most recent taxable year which would be calendar year “2019”.

MEUC Acceptable Documentation

If your tax return is not available (for example, because you have not filed your income tax return yet), acceptable documentation of self-employment income includes, but is not limited to:

- 1099

- Paycheck stubs

- Bank receipts

- Business records

- Self-employment ledger

- Form 1040 SE with Schedule C, F, or SE

- Form 1065 Schedule K1 with Schedule E

- Bookkeeping records, including receipts for all allowable expense

- Contracts

- Invoices

- Billing statements

Acceptable documentation does not include W-2 wages earned with an employer. The proof of income must be related to self-employment.

Documents submitted must substantiate self-employment income of at least $5,000 in net income during the most recent taxable year ending prior to your application for regular UC benefits.

You may submit this documentation at any time, however, MEUC payments will not begin until your self-employment income documentation can be verified. If you are found eligible for MEUC, you will be paid the $100 automatically with your weekly benefit payment.

Important Note:

MEUC is taxable income and payments will be included for purposes of determining income for Medicaid and the Children’s Health Insurance Program (CHIP). Therefore, MEUC payments may affect an individual’s eligibility for these programs.

How to Apply for Michigan UIA Mixed Earners Unemployment Compensation (MEUC) Program

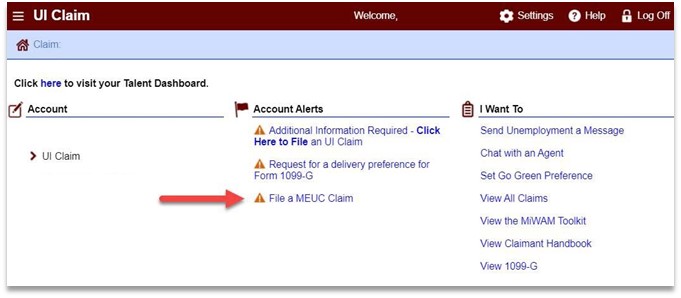

Apply online using MiWAM

- Log in to MiWAM at Michigan.gov/uia.

- Under Alerts, click on “File an MEUC claim” link follow the instructions to submit your application.

Upload documents verifying your self-employment income.

You may submit this documentation at any time, however, MEUC payments will not begin until your self-employment income documentation can be verified.

If you are found eligible for MEUC, you will be paid the $100 automatically with your weekly benefit payment.