2019 Minimum Wage Rates

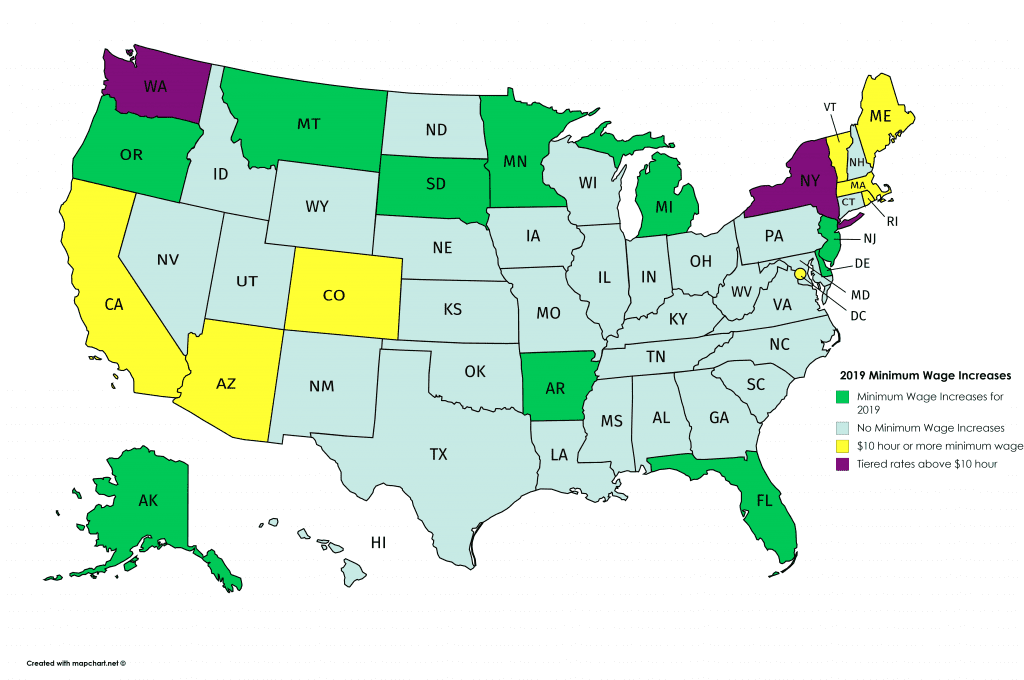

Happy New Year for 2019. The minimum wage in your State may have changed, as is tradition for many States.

While these minimum wage rates have increased for the last few years in many states, the Federal Minimum wage rate at $7.25 hasn’t changed since 2009 (unless you are attached to a Federal Government Contract).

On September 26, 2018, the Department of Labor published a Final Rule in the Federal Register: Minimum Wage for Contractors; Updating Regulations to Reflect Executive Order 13838.

On September 4, 2018, the Department of Labor published a Notice in the Federal Register to announce that, beginning January 1, 2019, the Executive Order 13658 minimum wage rate is increased to $10.60 per hour (83 FR 44906). This Executive Order minimum wage rate generally must be paid to workers performing work on or in connection with covered contracts. Additionally, beginning January 1, 2019, tipped employees performing work on or in connection with covered contracts generally must be paid a minimum cash wage of $7.40 per hour. Questions relating to the Executive Order and/or these wage rates may be directed to the Government Contracts Division at (202) 693-0064. – Department of Labor

Most likely unless you are working on Federal Government property, or project you will only have to be paid $7.25. Unless you happen to live in a state like New York, Washington, or Oregon, the county or city may dictates a higher minimum wage. New York state employees are even more tiered based on Airport employment.

The States listed below are getting minimum wage increases starting January 1, 2019 unless otherwise noted. 29 states in the country have minimum wage rates higher than the Federal Minimum wage of $7.25 per hour.

| State | 2016 Minimum Wage | 2017 Minimum Wage | 2018 Minimum Wage | 2019 Minimum Wage | Other Details |

|---|---|---|---|---|---|

| Alaska | $9.75 | $9.80 | $9.84 | $9.89 | |

| Arizona | $8.05 | $10.00 | $11.00 | Employees are entitled to paid sick leave, at the rate of one hour of paid sick time for every 30 hours worked, limitations exist based on employer size. | |

| Arkansas | $8.00 | $8.50 | $8.50 | $9.25 | Scheduled to reach $11 by 2021 |

| California | $10.00 | $10.50 | $12 if employer has more than 26 employees. $11 if under 26 employees. | On April 4, 2016, California Governor Edmund G. Brown Jr. signed legislation to gradually raise the state minimum wage with annual increases to reach $15 by 2022 for businesses with 26 or more employees and by 2023 for smaller employers. The plan also allows for the Governor to “pause” wage hikes, to be determined by September 1 of each year for the next year, if negative economic or budgetary conditions emerge (S.B. 3, L. 2016). | |

| Colorado | $8.31 | $9.30 | $11.10 | ||

| Delaware | $8.75 | $9.25 starting October 1, 2019 | |||

| District of Columbia | $13.25 | $14 starting July 1, 2019 | Under the “Fair Shot Minimum Wage Amendment Act of 2016,” the minimum wage will reach $15 per hour by 2020. Wages for tipped workers will also increase, eventually reaching $5 per hour by 2020. Starting in 2021 both wage rates will be adjusted based on inflation. DC Law 21-144 (Act 21-429; B21-712), effective from August 19, 2016 (63 DC Register 11135). | ||

| Florida | $8.05 | $8.10 | $8.25 | $8.46 | Based on a 2.59% increase in the cost of living. Wage rates are adjusted annually based on inflation. |

| Maine | $7.50 | $9.00 | $11.00 | ||

| Massachusetts | $10.00 | $11.00 | $12.00 | ||

| Michigan | $8.50 | $8.90 | $9.25 | $9.45 (effective 3-29-19) | Actually decreased from a prior planned raise to $10. The state recently passed legislation to slow the incremental increase over the next decade. |

| Minnesota | $7.87 | $9.86 if “large employer, or $8.04 if a smaller employer. | $9.86 per hour (up from $9.65) for employees of large employers with an annual gross volume of sales of not less than $500,000. Small employers must pay employees a minimum wage of at least $8.04 per hour (up from $7.87). | ||

| Missouri | $7.65 | $7.70 | $7.85 | $8.60 | Scheduled to increase each year by $0.85 per hour until 2023, when minimum wage reaches $12 per hour. |

| Montana | $8.05 | $8.15 | $8.30 | $8.50 | Raised because of 2.68% cost of living change, and rounded up to nearest 5 cents. Wages based on inflation. |

| New Jersey | $8.38 | $8.44 | $8.60 | $8.85 | Raised because of 2.88% cost of living change. Wages based on inflation. |

| New York | $9.00 | $9.70 | $15 per hour or $13.50 in New York City depending on employer size. $12 per hour in Nassau, Suffolk, and Westchester counties. All other counties are $11.10 per hour. | Tiered/Rates vary by region: $15 per hour, New York City employers with 11 or more employees, and $13.50 per hour, New York City employers with 10 or fewer employees; $12 per hour, Nassau, Suffolk and Westchester counties; $11.10 per hour, remainder of the state. Rate increases are included as part of the 2016 Budget Bill, Part K (S.B. 6406-C/A.B. 9006-C). | |

| The piece rate for Agricultural workers must be equivalent to the basic minimum wage, unless a youth rate certificate is issued (wage rate then must be equivalent to the youth rate). Existing wage orders are to be adjusted to reflect the wage increases. Paid family leave is also part of the Budget Bill. | |||||

| Fast Food Worker classification | $12.75 whole state or $15 in New York City | The minimum wage for workers in fast food establishments will be $15 per hour on December 31, 2018 in New York City and $12.75 per hour for fast food workers in the rest of the state. | |||

| Airport worker classification | $15 on January 1, 2019, and $15.60 by September 1, 2019. | The minimum wage at all airports (LaGuardia, JFK and Newark Liberty International) will be $15 on January 1, 2019 and will increase to $15.60 eff. September 1, 2019. | |||

| Ohio | $8.10 | $8.15 | $8.30 | $8.55 | Raise from a 2.9% increase in the cost of living. Wage rates are adjusted annually based on inflation. The minimum wage rate applies to employees of businesses with annual gross receipts of $314,000 per year (changed from $305,000 in 2018). For employees at smaller companies and for 14- and 15-year-olds, the state minimum wage is $7.25 per hour, which is tied to the Federal Rate. |

| Oregon | $9.75 | $10.25 | Metro Portland is $12 per hour and $12.50 July, 1, 2019. $10.75 for most of the state, and $11.25 July 1, 2019. | The state minimum wage is tiered, with the highest rate in the Metro Portland area at $12.00 per hour ($12.50 eff. July 1, 2019), the lowest in rural (non-Urban) areas at $10.50 per hour ($11 eff. July 1, 2019), and a minimum wage of $10.75 per hour ($11.25 eff. July 1, 2019) in the rest of the state. Scheduled increases per S.B. 1532, L. 2016. | |

| Rhode Island | $10.50 | H.B. 5175, L. 2017. | |||

| South Dakota | $8.55 | $8.65 | $8.85 | $9.10 | Based on 2.7% increase in the cost of living. Wage rates are adjusted annually based on inflation. |

| Vermont | $9.60 | $10.00 | $10.50 | $10.78 | $10.78 per hour. This is a 28-cent scheduled increase over the current $10.50 per hour. |

| Washington | $9.47 | $11.00 | $12 per hour (if over 18 years old). Workers under 16 can be paid $10.20 per hour. | $12 per hour, for employees who have reached the age of 18, per voter-approved Initiative 1433, effective January 1, 2017. Under Initiative 1433, the minimum wage will increase gradually to $13.50 by 2020. The Department of Labor and Industries will resume calculating the minimum wage for calendar years 2021 and beyond, based on increases in the cost of living. Workers under 16 years old can be paid 85 percent of the adult minimum wage, or $10.20 per hour, in 2019. The initiative also guarantees paid sick time to workers, allowing workers to accrue one hour of paid sick leave for every 40 hours worked. |

Here are the classifications of employees that do not meet the Department of Labor’s definition for “minimum wage” requirements.