How to file Your Weekly Unemployment Claim with Washington ESD

So you have been approved for Washington Employment Security Department unemployment insurance benefits, now you need to file a weekly claim in order to get paid. Just about every other state in the union would call this process certifying for unemployment insurance.

Watch this video for a the step by step guide to continue your weekly claim to Washington ESD online.

Weekly ESD Claim Methods

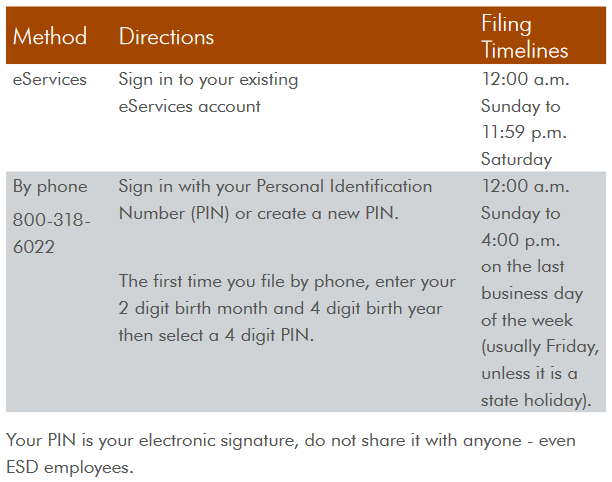

Filing online will be faster than by phone ESD Claims Center at 800-318-6022 24 hours a day, 7 days a week. ESD is experiencing an extremely high call volume due to increased demand, and many customers are not able to get through.

The questions asked when you file your weekly claim are the same whether you file online or by phone.

Weekly ESD Claim Questions

- Were you physically able and available for work each day?

- If you are unemployed as a result of COVID-19 because of business closures or you are at a high-risk of contracting COVID-19 and have been advised to self-quarantine, you should still answer “Yes” to this question.

- Did you make an active search for work, as directed, during the week you are now claiming?

- Unless your request for standby has been approved, receiving unemployment benefits requires you to actively look for work.

- Here are some suggestions to aid in you fulling your job search requirement during the COVID-19 outbreak:

- Apply for jobs through WorkSourceWA.com.

- Submit applications through search engines such as Indeed, CareerBuilder and Monster, to name a few.

- Calling employers you know are hiring about potential jobs.

- Completing available virtual workshops provided by WorkSource.

- Note: The jobs you apply for must be ones you have prior experience, training, or education. This is defined as suitable work.

- We will take into consideration any efforts made to complete the job search requirements when determining weekly unemployment eligibility.

- Here are some suggestions to aid in you fulling your job search requirement during the COVID-19 outbreak:

- If you answer “yes” to the question about an active search for work and you are not excused from your job-search requirements, you will be asked an additional question. You must certify that you made the appropriate number of employer contacts or in-person activities each week (at WorkSource or at an American Job Center in another state), and that you recorded this information on your job-search log.

- Out-of-state claimants also must be prepared to record job-search contacts for each week claimed.

- For employer contacts, you will be required to provide the following items from your job-search log for each contact made: the date; the business name and complete address; business phone number or email; how the contact was made; the person you contacted; and the type of work you were seeking.

- For in-person activities (at WorkSource or at an American Job Center in another state), you will be required to provide the following from your job-search log for each activity: the date, the office and a description of the activity.

- Did you refuse any offer of work or fail to go for a scheduled job interview?

- Have you applied for or received workers’ or crime victim’s compensation?*

- Have you applied for or did you have a change in pension?*

- Did you or will you receive holiday pay from your regular employer for any day of the week you are claiming?*

- Did you or will you receive vacation pay for any day of the week you are claiming?*

- Did you or will you receive pay in lieu of notice or termination pay for any day of the week you are claiming?*

- Did you serve on a jury?*

- Did you perform duty in the Military Reserve or National Guard for more than 72 consecutive hours?*

- Did you work in self-employment?*

- Did you work for any employer last week?*

Reporting Earnings to ESD

* Report earnings for the week in which you earned them, not in the week you received them. Report the total amount before deductions. For self-employment, report your net earnings. You also will be asked for the total hours or days for which you had earnings.

After entering your earnings

You will be asked, “Do you expect to be working for the same employer next week?” If you answer no, you must indicate the reason:

- Lack of work

- For example, that employer closed or reduced staff due to loss of business or public health directive during the COVID-19 outbreak.

- Reduced hours due to a lack of work

- Being fired

- You quit

- Some other reason

Did you have any other reportable earnings?

If you are not sure your earnings are reportable, see the list below from pages 27-28 in the Handbook for Unemployed Workers (PDF, 2.9MB).

When you complete your answers, the system will speak or display the message, “Your claim has been accepted.”

Reportable earnings include:

- Net income from your own business.

- In-kind payments that substitute for money, such as rent or room and board.

- Bonuses attributed to work performed in that week.

- Tips in any form.

- Paid vacation, holidays and sick leave.

- Military Reserve and National Guard pay if you worked more than three days in a row.

- Pay for jury duty service.

- Earnings from state work study (does not include Title IV funds).

- Pay from an employer, such as back pay (including back pay from a time-loss or workers’ compensation claim) for weeks you claimed.

If you make a mistake on your weekly claim

If you make a mistake while filing your weekly claim, you may start over any time before you hear or see, “Your claim has been accepted.” In most cases, you will have the opportunity to correct mistakes while submitting your claim.

If you discover your mistake after submitting your weekly claim, you’ll need to call and speak to a claims agent (800-318-6022 Monday – Friday from 8 a.m. – 4 p.m. except holidays) to correct the error.

Failing to call the claims center to correct your error could result in an overpayment and your benefits being denied.

You will need to log into your ESD account to file your weekly ESD unemployment benefit claim. https://secure.esd.wa.gov/home/